Will Intel’s new CEO lead Intel out of the chipmaking business, and how hard will his job be? Intel’s fiscal 2020 revenue was as high as $75.3 billion, up 5% from the previous year, with an operating profit margin of about 30%. Rapidly growing demand for PCs and data centers isn’t a solution to the company’s manufacturing woes, though…

On January 13, Western Time, Intel announced the appointment of Pat Gelsinger, who has technical experience, as the company’s new CEO, replacing Bob Swan, who has a financial background. Will the new CEO lead Intel out of the chipmaking business, and how hard will his job be? The company’s biggest rival just gave some big clues.

Pat Gelsinger won’t take over as Intel’s chief executive until mid-February, but the company’s fiscal fourth-quarter results, due on Thursday afternoon, could at least give a strong signal about his initial line of work. Intel has pledged to use the opportunity to update investors on its ongoing manufacturing issues.

Intel has also said that through this earnings release, it will indicate whether the company intends to stick to its long-standing practice of being the exclusive manufacturer of its own designed chips, or will begin to outsource the production of some future designs, likely to be outsourced. to TSMC.

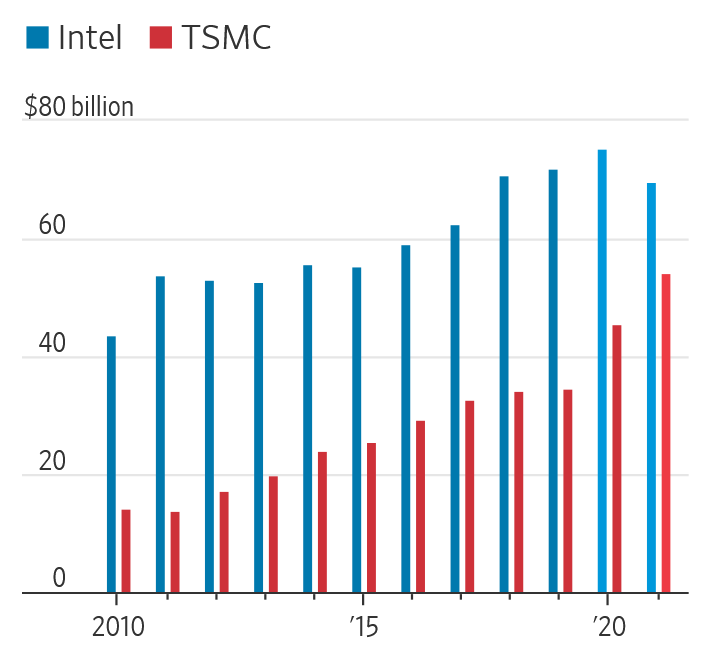

Comparison of Intel’s 2020-21 and TSMC’s 2021 revenue forecasts Source: Company data (actual); FactSet (forecast)

Pat Gelsinger’s experience as an Intel engineer strongly suggests that the chipmaker isn’t ready to give up manufacturing. But competing with the fledgling TSMC will be a daunting task.

TSMC reported on Thursday that revenue in 2020 surged 31% to a record $45.5 billion, the highest increase in more than a decade. TSMC also plans to spend record capital expenditures in 2021 to expand its production capacity due to strong demand from the company’s manufacturing operations. TSMC expects to invest $25 billion to $28 billion in 2021, which is twice Intel’s average annual capital expenditure over the past five years.

The latest report from IC Insights, a market research firm, pointed out that the shift of IC technology to 7nm and 5nm nodes and the successive mass production of Chinese memory manufacturers are the main driving forces for semiconductor capital expenditures in 2020; among them, the capital expenditures of wafer foundries It accounted for 34% of overall semiconductor infrastructure investment in the past 12 months.

Chinese foundry firm Semiconductor Manufacturing International Corporation (SMIC) is the leader in semiconductor capital expenditure growth, followed closely by Taiwan Semiconductor Manufacturing Company (TSMC). Overall foundry capital spending grew 38% to $36.3 billion in the third quarter of 2020.

IC Insights estimates that overall semiconductor capital spending in 2020 will grow 6% from 2019 to $108 billion. “Because of its focus on leading the provision of 7/5nm process technology, TSMC almost contributed to the growth of the overall foundry industry capital expenditure in 2019;” the agency estimates that TSMC’s capital expenditure will occupy the overall foundry industry in 2020. CapEx growth accounted for 20%, while SMIC’s contribution was 39%.

Comparing Intel’s 2010-21 and TSMC’s 2021 capex Sources: Company data (actual); FactSet (forecast)

Intel remains a much larger company with fiscal 2020 revenue of $75.3 billion, up 5% from the previous year, and an operating margin of about 30%. However, rapidly growing demand for PCs and data centers won’t solve the company’s manufacturing woes. Wall Street expects Intel’s revenue to fall 7% this year, which would be the company’s worst decline in more than a decade. TSMC expects revenue to rise 20 percent in 2021 to about $54.4 billion, according to FactSet.

Intel said there has been strong progress on the company’s 7-nanometer process technology, but TSMC is mass-producing more advanced 5-nanometer chips, and is even already developing 3-nanometer process technology, which will be mass-produced in the second half of 2022. That means that even if Mr. Gelsinger succeeds in getting Intel’s manufacturing process back on track, the company is still seriously behind. Bernstein’s Stacy Rasgon said Intel’s disadvantage to TSMC “may be deadlocked” for at least the next three years.

Some analysts also pointed out that Intel’s bottleneck in the semiconductor process is not only the delay of advanced process nodes, but the need to restructure the architecture to achieve a turnaround, which will cause Intel’s technological disadvantage to last for 5, 6, or even 7 years. time. In addition, whether it is a chip manufacturer or a wafer foundry, the more it goes to the “pyramid”, the greater the pressure it bears.

The Links: LM215WF3-SDDV AD9201ARSZRL