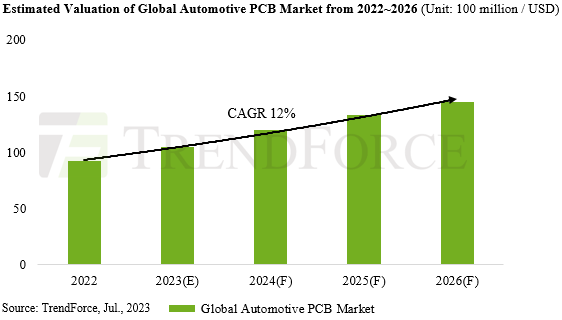

However the automotive PCB market will grow 14% to reach $10.5 billion and accounting for 13% of the total PCB market and representing a 12% CAGR 2022-6.

EV adoption is a significant growth driver for the automotive PCB market, given average PCB values for a BEV (Battery EV) are around 5 to 6 times that of a conventional fuel vehicle. Over half of these PCBs are installed in the BEV’s control system, which houses the battery management system connected via a wire harness.

The growing popularity of automotive lightweighting is leading to a gradual shift toward the use of flexible printed circuits, which will further increase the PCB within the electric control system.

Automotive PCBs mostly rely on 4 to 8-layer boards; autonomous driving systems often adopt higher-priced HDI boards, which are triple in price.

HDI boards used in light detection and ranging systems—equipped in L3 and more advanced autonomous driving systems—can cost tens of dollars and are a major contributor to the automotive PCB market’s future growth in value.

4 to 8-layer boards are expected to account for about 40% of the total automotive PCBs by 2023, falling to 32% by 2026.

In contrast, the proportion of HDI boards is projected to increase from 15% to 20%, and the proportion of FPC boards from 17% to 20%.

tAdditionally, the percentage of thick copper and RF boards will rise from 8% and 8.8% to 9.5% and 10.8%, respectively, while the proportion of lower-priced single and double-layer boards is predicted to decrease from 11.2% to 7.7%.